Filing your taxes chapter 10 lesson 4 – Delve into the intricacies of tax filing with Chapter 10 Lesson 4, an authoritative guide that unravels the complexities of tax requirements, document gathering, filing methods, and more. This comprehensive resource empowers you with the knowledge and strategies to navigate the tax landscape with confidence.

1. Understanding Tax Filing Requirements

Filing taxes is a legal obligation for individuals who meet certain criteria. Understanding the requirements is crucial to ensure compliance and avoid penalties.

Who is Required to File Taxes?

- Individuals with taxable income above a certain threshold

- Self-employed individuals

- Individuals who receive income from investments

Types of Tax Returns

- Form 1040: Individual Income Tax Return

- Form 1040-EZ: Simplified Income Tax Return

- Form 1040-SR: Senior Citizen Income Tax Return

Income and Expenses to Report

- Wages and salaries

- Investment income (e.g., dividends, capital gains)

- Business income and expenses

- Deductible expenses (e.g., mortgage interest, charitable donations)

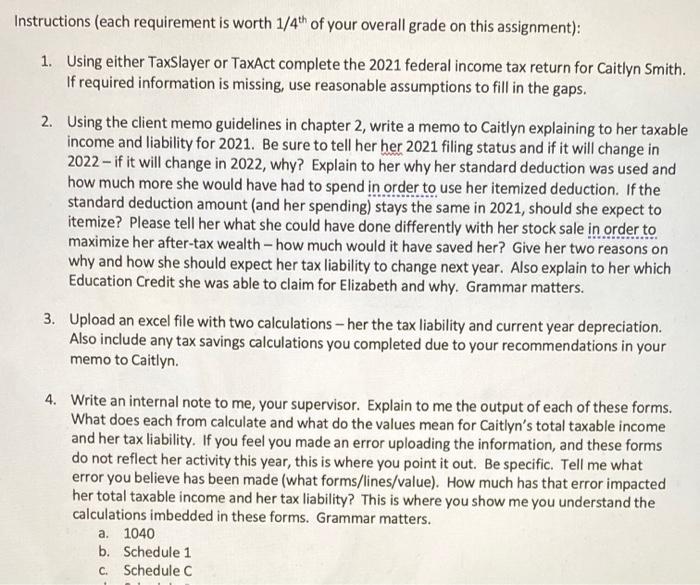

2. Gathering Necessary Documents

Preparing taxes requires gathering all relevant documents to ensure accuracy and completeness.

Essential Documents, Filing your taxes chapter 10 lesson 4

- Income statements (W-2, 1099, etc.)

- Expense receipts

- Bank statements

- Investment records

- Previous year’s tax return

Organizing Documents

Organizing documents by category and keeping them in a secure location is essential for efficient tax preparation.

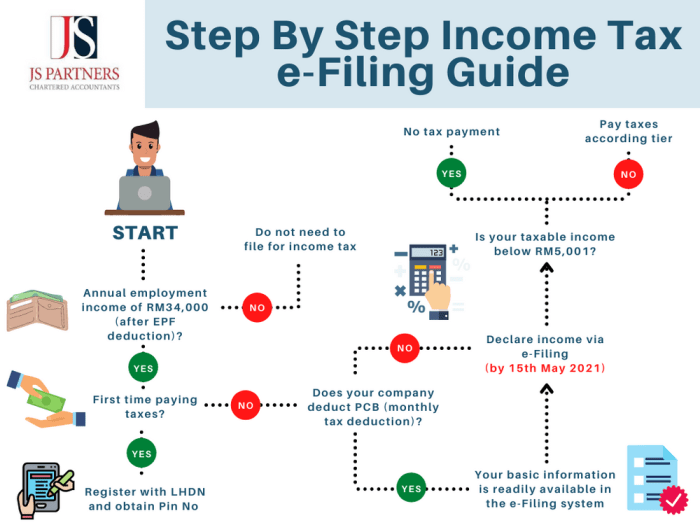

3. Choosing a Filing Method: Filing Your Taxes Chapter 10 Lesson 4

Individuals have several options for filing their taxes, each with its advantages and disadvantages.

Electronic Filing

- Convenience and speed

- Error checks and automatic calculations

- Additional fees may apply

Mail-in Filing

- Traditional method

- Free of charge

- Prone to delays and errors

Professional Tax Preparation Services

- Expertise and accuracy

- Time-saving

- Fees can be substantial

Key Questions Answered

What are the different types of tax returns individuals need to file?

Individuals typically file Form 1040, 1040-EZ, or 1040-SR, depending on their income and filing status.

What documents are essential for tax filing?

Gather income statements (W-2, 1099), expense receipts, bank statements, and investment records.

How can I choose the best tax filing method?

Consider electronic filing for convenience and accuracy, mail-in filing for simplicity, or professional tax preparation services for expert assistance.